Background of the Company

China Star Entertainment Group was established in 1992 by Charles Heung, who is the studio's CEO chairman, with his wife, Tiffany Chen, serving as Vice Chairman and administrative producer. It is a huge distributor and film producer of films made mostly in Cantonese dialect.

China Star Entertainment and its subsidiaries are principally engaged in the production and distribution of films and television drama series that are in Chinese dialect, many of which have won various awards. The company has also engaged in the provision of artists management services and post-production services.

In recent years, it has restarted its hotel operations, and acquired a company that has claim on the profits of those generated in one of the VIP rooms in the Grand Lisboa, Macau.

(as taken from wikipedia)

I am sure that many of us have watched the films that they have produced, such as Love on a Diet, La Brassiere and My Left Eyes Sees Ghost.

In 2006, CSE acquired Kingsway Hotel Limited in Macau, and refurbished it before reopening it in August 2009. The hotel has 200 rooms, a gaming room, with table games and slot machines.

In 2008, CSE acquired Best Mind International Inc, which has a 100% in 0.4% of the turnover generated by Ocho Sociedade Unipessoal Limitada. Ocho is a junket representative in one of the VIP gaming rooms at the Grand Lisboa Casino in Macau. A profit guarantee was provided of HK$72 million, HK$192 million and HK$120 million for the period from 17 August 2007 to 31 December 2007, the year ended 31 December 2008 and the period from 1 January 2009 to 16 August 2009 respectively.

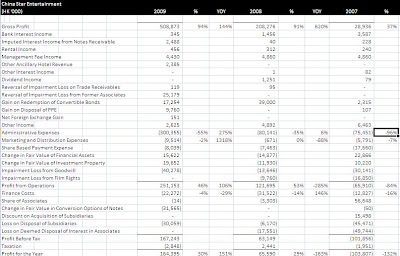

Income Statement

As we can see, the hotel operations were only started in 2009, and the gaming promotion operations started in 2008.

As we can see, the hotel operations were only started in 2009, and the gaming promotion operations started in 2008.What is interesting to note is that as of 2008, the gaming promotion operations generated HKD203,327,000, which as stated on the annual report was 34% higher than the HKD151,385,000, which was different from the profit guarantee as stated in their company profile of HKD 192million. Likewise, the profit guarantee was not restated in 2008 for the year 2007, of HKD 72million. I spent very long trying to figure out this red flag, and came to two possible conclusions. (1) the profit guarantee was restated as of date of acquisition, or (2) the company restated its profit guarantee as it sees fit.

This doubt did not last for long, as seeing the amount the gaming promotion operations is bringing in, it shows that the demand for gaming is there, and this would also help out its hotel business, which has its own gaming arm as well. Furthermore, it shows that high end gamblers are still flocking to Macau despite the financial crisis that happened. Overall, the revenue obtained from the gaming arm was about 29.7% more than the guaranteed amount.

Generally, the average occupancy rate of hotel rooms in Macau increased from 75.47% in March 2008, to 82.22% in December 2009, with a dip in between. As of March 2010, the average occupancy rate was hovering about 77%. Gross gaming revenue of Macau, however, has recovered from a previous high of MOP10,220million in March 2008 before the financial meltdown to MOP 11,450.6 in Dec 2009. In March 2010, gaming revenue was recorded at MOP13,665.9million.

Another point to note is how badly the film distribution arm is doing. The segment profit was HKD8,336,000 in 2007, a loss of HKD19,128,000 in 2008 and another loss of HKD11,738,000 in 2009. The company has attributed it to rampant piracy that is eating away at their margins, and in this case, posting net losses. I look for China Star Entertainment to divest its holdings or shut down its film distribution arm sooner rather than later.

The amount of turnover from the VIP room at Grand Lisboa has allowed it to increase its gross margins to 90%.

One thing that stands out is the admin expenses (the row where the cursor is). Admin expenses has risen by 275% year on year, while marketing and distribution expenses increased by 1318%. This was attributable to the opening of the LKF hotel in Macau, as SG&A expenses were incurred throughout the year, but revenue collection only started in August.

One thing that stands out is the admin expenses (the row where the cursor is). Admin expenses has risen by 275% year on year, while marketing and distribution expenses increased by 1318%. This was attributable to the opening of the LKF hotel in Macau, as SG&A expenses were incurred throughout the year, but revenue collection only started in August.Another point that makes me feel uncomfortable is the high finance costs, being 4% of sales. However, this is offset by the low cost of sales attributable to the Gaming Promotion Arm. I look for them to lower the absolute amount. There was a 29% decrease from 2008. Although the absolute bank borrowings increased (that will be covered in the Balance Sheet analysis), CSE has managed to reduce the interest expense due to lower borrowing rates. However, there is a bank overdraft liability that exists on the balance sheet that has not been paid off.

Over the past 2 years, CSE has retained most of its profit, only paying out 5.46% of its total profits made over the period.

The P/E ratio at its current price based on 2009 earnings is 0.66, while based on the current number of shares issued, the P/E average of 2 years earnings (since the acquisition of Kingsway Hotel and Best Mind International) is 1.16.

Balance Sheet

Several key figures found in the balance sheet

- Assets as of YE2009 totaled HKD3190million

- Current Assets as of YE2009 totaled 853million

- Intangible Assets + GW as of YE2009 totaled HKD998million

- Liabilities as of YE2009 totaled HKD870million

- Bank Borrowings totaled HKD410million, of which 232million is classified as current liabilities. There has been a marginal reduction of bank borrowings from 2008.

- Bank Overdraft was not repaid in 2009, instead it has increased from HKD174million to HKD 178million.

The figures are for 2009 (on the left) vs 2008. What is noteworthy is that the leverage of the company has decreased, and the current ratio of the company has increased. Although the net current asset per share is negative, it has been reduced from HKD-0.6 to HKD-0.02. The NTA of the company is at 1.43, a 33 cents increase from 2008. Given it's current price, it is trading at a discount of 89.5% to its tangible book value.

The figures are for 2009 (on the left) vs 2008. What is noteworthy is that the leverage of the company has decreased, and the current ratio of the company has increased. Although the net current asset per share is negative, it has been reduced from HKD-0.6 to HKD-0.02. The NTA of the company is at 1.43, a 33 cents increase from 2008. Given it's current price, it is trading at a discount of 89.5% to its tangible book value.Why Purchase?

There are some lingering doubts that I had before I purchased the shares of the company

(1) Why wasn't bank overdraft repaid? Are they in a need of cash for working capital purposes?

An analysis of the Cash Flow statement puts Free Cash Flow marginally positive for the year ended 2009. For 2008, FCF was negative. Working Capital was HKD46million for year ended 2009, compared to year ended 2008, which was HKD-34million.

With the reassurance that the cash flow was improving, the bank overdraft not being repaid does not warrant a huge emphasis. Instead, I would look the the company to decrease the overdraft over the next year.

(2) Lack of a Dividend

The company, even before it's diversification, has not paid out dividends to its shareholders except in 2008, of HKD0.02. This is due to the need to retain cash for its diversification policies in order to deal with the decreasing profits/increasing losses from the film distribution arm. I do not foresee a dividend in the coming year, however within the next 2 financial years, should results continue improving, the lack of a dividend would be a red flag.

(3) Possible Divestment of Film Distribution Arm

I would look for the company to divest its money bleeding film distribution arm over the next few years. Should the company continue this arm for reasons other than profiteering, I would have to reconsider the investment in CSE.

Conclusion

I definitely feel that CSE is a company reborn since its diversification. Its results have been impressive, and should it manage to reduce the bank overdraft over the next year, it would show good management decisions being made.

It would also be good to look at the results for the next few quarters, as the profit guarantee has expired. However, with the amount of revenue being brought in by the gaming promotion arm exceeding the profit guarantee, it does not seem like a big worry.

No comments:

Post a Comment