Wednesday, July 21, 2010

Macau Gaming Industry

Saturday, July 3, 2010

Portfolio Summary June 2009

Well on a lighter note, world cup has been keeping me (and everyone else) up. So I wish to apologize for the lack of updates, as juggling world cup, work and sleep isn't a very fun thing to do.

Among my holdings the only news that was announced was for these following companies.

Among my holdings the only news that was announced was for these following companies.Novo Group - Results

Novo Group's results were released on the 21st of June. The results were disappointing with 4Q revenue decreasing over last year. Recall that the 4Q last year was from the period from Mar to Jun 09 where the global economy was just recovering, and economies in North East Asia being in their recovery phase.

Novo attributed the decrease to a slower growth rate in China and a rein in property development in china, decreasing the demand in steel. Steel has seen excess supply especially for those needed in construction of infrastructure. However, cold rolled steel for the manufacturing of appliances is still in demand. However, with credit reigned in in China, and excess supply in India seems to depress demand and pricing for steel.

I am looking to unload Novo in the near future, with steel pricing forecasted to not pick up before 2012.

The dividend payable for the year is at 0.5 cents per share.

YRC Worldwide - Asset Sale

YRC Worldwide has sold off its logisitics arm to Austin Ventures for $37 million. A quick calculation of the debt remaining after exhausting their loan capacity and repayment of trade payables and loans totalled about 93 million for 2010.

YRC Worldwide needs to generate a positive EBITDA, as well as positive cash flow to ensure liquidity does not dry up. The operational statistics seem to be bottoming out, and the next release of results will be crucial in determining it. The most important thing in the trucking industry is that while there is still excess capacity, the price wars are over and most trucking firms are aiming to reduce capacity.

China Star Entertainment - Bonus Issue

China Star Entertainment issued 1 bonus warrant for every 4 shares held. I made a mistake previously, as I commented that the warrants will be sold off. In fact, my broker has informed me that my warrants are held in my account already, and I had to incur a charge of SGD9.21. I am travelling to Macau and Hong Kong in August, and hopefully I'll have the chance to either meet the management, and visit their hotel in Macau.

Sunday, June 6, 2010

Portfolio Summary May 2010

Over the month of May, the S&P500 shed about 100 points off its value (8.4%). The same stories arose this month, with debt being the main focus. This week however, renewed doubt over the recovery, with private hiring not up in the US.

Doubts over China's growth also took place in May, with a slowdown in the manufacturing sector reported.

My porfolio took a hit last month, and as of the end of May, I am 2.9% in the red.

My porfolio took a hit last month, and as of the end of May, I am 2.9% in the red.First Resources

No news was reported for First Resources this month. Dividends was received on the 18th of May 2010 for Year End 2009

China Telecom

At the AGM, all motions were duly passed. This includes a HKD0.085 dividend per share to be issued on the 30th of June 2010

Novo Group

Novo disposed of its downstream subsidiary to its partner. The disposal is not expected to have any material impact on its results.

The reason given is as follows,

"In view that the definitive terms and conditions imposed bythe relevant authorities are more stringent than the original understandings of the Company, inparticular, in respect of the investment commitment requirements, the Company has decidednot to participate in the Project at this stage... JV Partner has already signed a legal binding MOU with the Group, offering a first right of refusal to subscribe for up to 60% of the equity in the investment holding company controlled by the JV Partner that will be undertaking the Project."

In my opinion, this is a step back for the company. Firstly, it has underestimated the problems that it may encounter when setting up a subsidiary in China. Next, in my opinion, it is a blow to the company that it has failed to expand its downstream operations.

However, as the project has not started, and as such is not expected to have any material impact, I would still be interested to see where Novo Group heads.

Soilbuild

Soilbuild announced its 1Q2010 results this month. Although sales were down, due to a decrease in revenue from property development, rental income increased by 40% year on year. This is positive for the company as it strives to achieve its 40million revenue from rental income.

NAV increased by 5 cents to 1.29, in spite of an increase in number of shares (1,516,000) due to exercise of warrants.

China Star Entertainment

A bonus issue of warrants is slated to be done, pending shareholder approval. The subscription price is HKD0.193. For foreign shareholders, the warrants will be sold at the first possible opportunity, and the proceeds will be credited to the shareholder account

Courage Marine

I purchased Courage Marine at SGD0.185 on the 22nd of May. I previously looked at the Shipping sector, and as the turnaround in container shipping is expected, the dry bulk shipping sector would typically be correlated to the turnaround in container shipping, albeit a little slower.

Courage Marine has a very strong balance sheet, and by purchasing 2nd hand ships, they would obtain a higher return on investment. The fact that Courage charters out ships typically using spot prices, means it would gain the full benefit on the turnaround of container shipping.

Its revenue has increased not only year on year, but also quarter on quarter, and gross margins have been improving. This points to a possible turnaround in shipping.

I did not over BGEM and YRCW, as I am still in the process of redoing my portfolio.

Saturday, May 15, 2010

YRC Worldwide 1Q Results

YRC Worldwide Reports First Quarter 2010 Results

--YRC National Reports Year-over-Year Adjusted EBITDA Improvement --YRC Regional Reports Third Straight Quarter of Positive Adjusted EBITDA

OVERLAND PARK, Kan., May 4, 2010 /PRNewswire via COMTEX/ -- YRC Worldwide Inc. (YRCW 0.44, +0.00, +0.16%) today reported its first quarter 2010 results. For the quarter ending March 31, 2010, the company announced a loss per share of $.33 when excluding a previously announced charge of $.20 per share for union employee equity-based awards, and a $.53 loss per share when including that item. By comparison, the company reported a $4.61 loss per share in the first quarter of 2009.

"Despite the headwinds from the note exchange in the latter part of December and the harsh winter weather we experienced during January and February, we are pleased with the sequential operating improvement during the quarter and the traction we achieved in the month of March," stated Bill Zollars, Chairman, President and CEO of YRC Worldwide. "The Regional companies have a lot of momentum, while YRC has stabilized its customer base and streamlined its sales force, and is poised for growth going forward."

For the first quarter of 2010, the company reported operating cash flow of $18 million, including the receipt of the previously announced $82 million income tax refund in late February. The company issued $50 million of 6% notes on February 23, 2010, and used the net proceeds from these new notes to redeem its remaining 8.5% notes that were due April 15, 2010. In addition, the company repaid $29 million on its asset-backed securitization ("ABS") facility primarily from collections of its fourth quarter revenues. At March 31, 2010, the company reported cash and cash equivalents of $130 million, unused revolver reserves of $107 million and unrestricted availability of $4 million under the company's $950 million revolving credit facility.

"Our operating results improved sequentially throughout the quarter as reflected in our adjusted EBITDA of $(27) million in January, $(21) million in February, and $(5) million in March," added Sheila Taylor, Executive Vice President and CFO of YRC Worldwide. "We continue to remove additional cost from the business and more effectively manage our working capital, which has allowed us to preserve liquidity under our credit facility."

Adjusted EBITDA is a non-GAAP measure that reflects the company's earnings before interest, taxes, depreciation, and amortization expense, and further adjusted for letter of credit fees and other items as defined in the company's Credit Agreement. "Adjusted EBITDA" and "loss per share when excluding the charge for union employee equity-based awards" are used for internal management purposes as financial measures that reflect the company's core operating performance. In addition, adjusted EBITDA is used by management to measure compliance with financial covenants in the company's Credit Agreement. However, these financial measures should not be construed as a better measurement than operating income or earnings per share, as defined by generally accepted accounting principles. See the reconciliation of GAAP measures to non-GAAP financial measures below.

Key Segment Information

First quarter 2010 compared to the first quarter 2009:

YRC National Transportation total shipments per day down 33.6%, total tons per day down 34.6%, with March tons per day down 22.5%, and total revenue per hundredweight, including fuel surcharge, up .4%.

YRC Regional Transportation total shipments per day down 12.9%, total tons per day down 9.1%, with March tons per day down 3.2%, and total revenue per hundredweight, including fuel surcharge, down 2.3%.

Additional statistical information is available on the company's website at yrcw.com under Investors, Earnings Releases & Operating Statistics.

Outlook

During April, YRC National and YRC Regional volumes increased compared to March, as both sequential trends were slightly better than normal seasonal patterns.

"We appreciate the continued confidence our customers have shown by increasing their shipments with us throughout the quarter and into April," stated Mr. Zollars. "With our current operating momentum, we still believe we will generate positive adjusted EBITDA in the second quarter."

In addition to the above, we have the following expectations for 2010:

Gross capital expenditures in the range of $50 to $75 million

Real estate sales in the range of $25 to $50 million

Sale and financing leasebacks of approximately $50 million, primarily in the second half of the year

Interest expense in the range of $40 to $45 million per quarter, with cash interest of $10 million to $12 million per quarter

Effective income tax rate of 2%

Outstanding shares of 1.054 billion, prior to any adjustments for a reverse stock split and the issuance of equity

Amendment to Credit Facilities

On May 3, 2010, the company completed amendments to its $950 million revolving credit facility and $400 million ABS facility. Under the revolving credit facility, the company may retain up to $100 million of net proceeds from the issuance of equity prior to December 31, 2010. Previously, the lenders would have received 50% of the net proceeds from an equity issuance. In addition, the company's financial covenants were reset for the remainder of 2010 to take into account the impact to the company's customer base from the delayed note exchange at the end of 2009. The adjusted EBITDA covenants are $5 million for second quarter of 2010, $50 million cumulative for second and third quarters of 2010, and $100 million cumulative for second, third and fourth quarters of 2010. In addition, the company is required to maintain minimum available cash (as defined in its credit agreement) of $25 million through the remainder of the year.

"These amendments are another indication of the support our lenders continue to provide as we manage past the seasonally slowest time of year and rebuild our value in the market place," stated Ms. Taylor. "We are also encouraged with the activity in the equity markets and expect to be opportunistic throughout the year."

Review of Financial Results

YRC Worldwide Inc. will host a conference call for shareholders and the investment community today, Tuesday, May 4, 2010, beginning at 9:30am ET, 8:30am CT. The conference call will be open to listeners via the YRC Worldwide Internet site yrcw.com. An audio playback will be available after the call also via the YRC Worldwide web site.

Reconciliation of GAAP Measures to Non-GAAP Financial

Measures (unaudited)

-----------------------------------------------------

(in millions) January February March

------------- 2010 2010 2010

---- ---- ----

Reconciliation of operating loss

to adjusted EBITDA:

Operating loss $(49) $(42) $(146)

Depreciation and amortization 17 17 18

Equity based compensation expense 1 1 108

Letter of credit expense 3 3 3

Losses on property disposals, net - - 9

Impairment charges - - 5

Other, net 1 - (2)

--- --- ---

Adjusted EBITDA $(27) $(21) $(5)

==== ==== ===

For the Three Months Ended March

31

--------------------------------

(in millions) 2010 2009

------------- ---- ----

Reconciliation of operating loss

to adjusted EBITDA:

Operating loss $(237) $(379)

Depreciation and amortization 52 66

Equity based compensation expense 110 33

Letter of credit expense 9 5

Losses on property disposals, net 9 2

Impairment charges 5 -

Other, net (1) (2)

--- ---

Adjusted EBITDA $(53) $(275)

==== =====

Adjusted EBITDA by segment:

YRC National Transportation $(60) $(239)

YRC Regional Transportation 8 (50)

YRC Logistics (6) (1)

YRC Truckload - -

Corporate and other 5 15

--- ---

Adjusted EBITDA $(53) $(275)

==== =====

Forward-Looking Statements:

This news release and statements made on the conference call for shareholder and the investment community contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words "believe," "expect," "continue," and similar expressions are intended to identify forward-looking statements. It is important to note that the company's actual future results could differ materially from those projected in such forward-looking statements because of a number of factors, including (among others) our ability to generate sufficient cash flows and liquidity to fund operations, which raises substantial doubt about our ability to continue as a going concern, inflation, inclement weather, price and availability of fuel, sudden changes in the cost of fuel or the index upon which the company bases its fuel surcharge, competitor pricing activity, expense volatility, including (without limitation) expense volatility due to changes in rail service or pricing for rail service, ability to capture cost reductions, changes in equity and debt markets, a downturn in general or regional economic activity, effects of a terrorist attack, labor relations, including (without limitation) the impact of work rules, work stoppages, strikes or other disruptions, any obligations to multi-employer health, welfare and pension plans, wage requirements and employee satisfaction, and the risk factors that are from time to time included in the company's reports filed with the SEC, including the company's Annual Report on Form 10-K for the year ended December 31, 2009.

The company's expectations regarding the timing and degree of market share growth are only its expectations regarding these matters. Actual timing and degree of market share growth could differ based on a number of factors including (among others) the company's ability to persuade existing customers to increase shipments with the company and to attract new customers, and the factors that affect revenue results (including the risk factors that are from time to time included in the company's reports filed with the SEC, including the Company's annual report on Form 10-K for the year ended December 31, 2009).

The company's expectations regarding the impact of, and the service and operational improvements and collateral and cost reductions due to, the integration of Yellow Transportation and Roadway, improved safety performance, right-sizing the network, consolidation of support functions, the company's credit ratings and the timing of achieving the improvements and cost reductions could differ materially from actual improvements and cost reductions based on a number of factors, including (among others) the factors identified in the prior paragraphs above, the ability to identify and implement cost reductions in the time frame needed to achieve these expectations, the success of the company's operating plans and programs, the company's ability to successfully reduce collateral requirements for its insurance programs, which in turn is dependent upon the company's safety performance, ability to reduce the cost of claims through claims management, the company's credit ratings and the requirements of state workers' compensation agencies and insurers for collateral for self insured portions of workers' compensation programs, the need to spend additional capital to implement cost reduction opportunities, including (without limitation) to terminate, amend or renegotiate prior contractual commitments, the accuracy of the company's estimates of its spending requirements, changes in the company's strategic direction, the need to replace any unanticipated losses in capital assets, approval of the affected unionized employees of changes needed to complete the integration under the company's union agreements, the readiness of employees to utilize new combined processes, the effectiveness of deploying existing technology necessary to facilitate the combination of processes, the ability of the company to receive expected price for its services from the combined network and customer acceptance of those services.

The company's expectations regarding its ability to raise new capital in the equity markets are only its expectations regarding this matter. Whether the company is able to raise new capital is dependent upon a number of factors including (among others) the trading price and volume of the company's common stock and the company reaching agreement with interested investors and closing such transactions on negotiated terms and conditions, including (without limitation) any closing conditions that investors may require.

The company's expectations regarding future asset dispositions and sale and financing leasebacks of real estate are only its expectations regarding these matters. Actual dispositions and sale and financing leasebacks will be determined by the availability of capital and willing buyers and counterparties in the market and the outcome of discussions to enter into and close any such transactions on negotiated terms and conditions, including (without limitation) usual and ordinary closing conditions such as favorable title reports or opinions and favorable environmental assessments of specific properties.

The company's expectations regarding interest and fees (including any deferred amounts) are only its expectations regarding these matters. Actual interest and fees (including any deferred amounts) could differ based on a number of factors, including (among others) the company's expected borrowings under the company's credit agreement and the ABS facility, which is affected by revenue and profitability results and the factors that affect revenue and profitability results (including the risk factors that are from time to time included in the company's reports filed with the SEC, including the company's annual report on Form 10-K for the year ended December 31, 2009), and the company's ability to continue to defer the payment of interest and fees pursuant to the terms of the company's credit agreement, ABS facility and pension fund contribution deferral agreement, as applicable.

The company's expectations regarding its capital expenditures are only its expectations regarding this matter. Actual expenditures could differ materially based on a number of factors, including (among others) the factors identified in the preceding paragraphs.

The company's expectations regarding liquidity are only its expectations regarding this matter. Actual liquidity levels will depend upon (among other things) the company's operating results, the timing of its receipts and disbursements, the company's access to credit facilities or credit markets, the company's ability to continue to defer interest and fees under the company's credit agreement and ABS facility and interest and principal under the company's contribution deferral agreement, the continuation of the existing union wage reductions and temporary cessation of pension contributions, and the factors identified in the preceding paragraphs.

The company's expectations regarding its effective tax rate are only its expectations regarding this rate. The actual rate could differ materially based on a number of factors, including (among others) variances in pre-tax earnings on both a consolidated and business unit basis, variance in pre-tax earnings by jurisdiction, impacts on our business from the factors described above, variances in estimates on non-deductible expenses, tax authority audit adjustments, change in tax rates and availability of tax credits.

YRC Worldwide Inc., a Fortune 500 company headquartered in Overland Park, Kan., is one of the largest transportation service providers in the world and the holding company for a portfolio of successful brands including YRC, YRC Reimer, YRC Glen Moore, YRC Logistics, New Penn, Holland and Reddaway. YRC Worldwide has the largest, most comprehensive network in North America, with local, regional, national and international capabilities. Through its team of experienced service professionals, YRC Worldwide offers industry-leading expertise in heavyweight shipments and flexible supply chain solutions, ensuring customers can ship industrial, commercial and retail goods with confidence. Please visit yrcw.com for more information.

Investor Paul Media Suzanne

Contact: Liljegren Contact: Dawson

YRC Linden

Worldwide Alschuler

Inc. & Kaplan

913.696.6108 212.329.1420

Paul.Liljegren@yrcw.com sdawson@lakpr.com

CONSOLIDATED BALANCE SHEETS

YRC Worldwide Inc. and Subsidiaries

(Amounts in thousands except per share data)

March 31, December 31,

2010 2009

---- ----

ASSETS (Unaudited)

CURRENT ASSETS:

Cash and cash equivalents $130,263 $97,788

Accounts receivable, net 517,093 515,807

Prepaid expenses and other 178,322 245,225

------- -------

Total current assets 825,678 858,820

------- -------

PROPERTY AND EQUIPMENT:

Cost 3,520,447 3,588,474

Less - accumulated depreciation 1,745,423 1,748,996

--------- ---------

Net property and equipment 1,775,024 1,839,478

--------- ---------

OTHER ASSETS:

Intangibles, net 153,389 163,544

Other assets 165,115 170,232

------- -------

Total assets $2,919,206 $3,032,074

========== ==========

LIABILITIES AND SHAREHOLDERS' EQUITY

(DEFICIT)

CURRENT LIABILITIES:

Accounts payable $214,525 $198,725

Wages, vacations, and employees'

benefits 209,349 216,074

Other current and accrued liabilities 567,417 397,902

Current maturities of long-term debt 211,603 197,127

------- -------

Total current liabilities 1,202,894 1,009,828

--------- ---------

OTHER LIABILITIES:

Long-term debt, less current portion 948,864 935,782

Deferred income taxes, net 145,751 146,576

Pension and post retirement 353,398 351,861

Claims and other liabilities 373,243 420,837

SHAREHOLDERS' EQUITY (DEFICIT):

Preferred stock, $1 par value per share - 4,346

Common stock, $0.01 par value per share 10,566 991

Capital surplus 1,571,413 1,576,349

Accumulated deficit (1,451,418) (1,177,280)

Accumulated other comprehensive loss (142,768) (144,479)

Treasury stock, at cost (3,079 shares) (92,737) (92,737)

------- -------

Total shareholders' equity (deficit) (104,944) 167,190

-------- -------

Total liabilities and shareholders'

equity (deficit) $2,919,206 $3,032,074

========== ==========

STATEMENTS OF CONSOLIDATED OPERATIONS

YRC Worldwide Inc. and Subsidiaries

For the Three Months Ended March 31

(Amounts in thousands except per share data)

(Unaudited)

2010 2009

---- ----

OPERATING REVENUE $1,063,235 $1,502,795

---------- ----------

OPERATING EXPENSES:

Salaries, wages, and employees'

benefits 670,826 1,133,974

Equity based compensation

expense 109,871 33,025

Operating expenses and supplies 253,349 367,292

Purchased transportation 132,456 175,184

Depreciation and amortization 52,261 66,269

Other operating expenses 67,013 104,705

Losses on property disposals,

net 8,998 1,593

Impairment charges 5,281 -

----- ---

Total operating expenses 1,300,055 1,882,042

--------- ---------

OPERATING INCOME (LOSS) (236,820) (379,247)

-------- --------

NONOPERATING (INCOME) EXPENSES:

Interest expense 41,074 32,219

Other 2,178 3,701

----- -----

Nonoperating expenses, net 43,252 35,920

------ ------

INCOME (LOSS) BEFORE INCOME

TAXES (280,072) (415,167)

INCOME TAX PROVISION (BENEFIT) (5,934) (141,385)

NET INCOME (LOSS) $(274,138) $(273,782)

========= =========

AVERAGE SHARES OUTSTANDING-

BASIC 521,216 59,373

AVERAGE SHARES OUTSTANDING-

DILUTED 521,216 59,373

BASIC EARNINGS (LOSS) PER SHARE $(0.53) $(4.61)

DILUTED EARNINGS (LOSS) PER

SHARE $(0.53) $(4.61)

STATEMENTS OF CONSOLIDATED CASH FLOWS

YRC Worldwide Inc. and Subsidiaries

For the Three Months Ended March 31

(Amounts in thousands)

(Unaudited)

2010 2009

---- ----

OPERATING ACTIVITIES:

Net income (loss) $(274,138) $(273,782)

Noncash items included in net income

(loss):

Depreciation and amortization 52,261 66,269

Equity based compensation expense 109,871 33,025

Impairment charges 5,281 -

Pension settlement charge - 5,003

Losses on property disposals, net 8,998 1,593

Deferred income tax benefit, net (5,841) (141,741)

Amortization of deferred debt costs 10,516 4,488

Other noncash items 1,964 2,836

Changes in assets and liabilities, net:

Accounts receivable (1,317) 118,740

Accounts payable 15,811 (49,863)

Other operating assets 71,213 52,307

Other operating liabilities 23,671 87,119

------ ------

Net cash provided by (used in) operating

activities 18,290 (94,006)

------ -------

INVESTING ACTIVITIES:

Acquisition of property and equipment (3,731) (15,424)

Proceeds from disposal of property and

equipment 7,637 18,707

Restricted cash - (17,617)

Other - (198)

--- ----

Net cash provided by (used in) investing

activities 3,906 (14,532)

----- -------

FINANCING ACTIVITIES:

ABS borrowings (payments), net (28,618) 41,211

Issuance of long-term debt 119,748 157,617

Repayment of long-term debt (59,363) (129,149)

Debt issuance costs (7,030) (37,971)

Equity issuance costs (14,458) -

------- ---

Net cash provided by financing activities 10,279 31,708

------ ------

NET INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS 32,475 (76,830)

CASH AND CASH EQUIVALENTS, BEGINNING OF

PERIOD 97,788 325,349

CASH AND CASH EQUIVALENTS, END OF PERIOD $130,263 $248,519

======== ========

SUPPLEMENTAL CASH FLOW INFORMATION

Income tax refund, net $81,272 $37,266

Pension contribution deferral transfer to

debt $3,488 $-

SUPPLEMENTAL FINANCIAL INFORMATION

YRC Worldwide Inc. and Subsidiaries

For the Three Months Ended March 31

(Amounts in thousands)

(Unaudited)

2010 2009 %

---- ---- ---

Operating revenue:

YRC National Transportation $663,063 $1,022,610 (35.2)

YRC Regional Transportation 309,154 355,168 (13.0)

YRC Logistics 76,092 112,120 (32.1)

YRC Truckload 26,885 25,976 3.5

Eliminations (11,959) (13,079)

------- -------

Consolidated 1,063,235 1,502,795 (29.2)

Operating income (loss):

YRC National Transportation (185,060) (299,771)

YRC Regional Transportation (39,631) (74,125)

YRC Logistics (7,448) (3,444)

YRC Truckload (3,061) (2,246)

Corporate and other (1,620) 339

------ ---

Consolidated $(236,820) $(379,247)

Operating ratio:

YRC National Transportation 127.9% 129.3%

YRC Regional Transportation 112.8% 120.9%

YRC Logistics 109.8% 103.1%

YRC Truckload 111.4% 108.6%

Consolidated 122.3% 125.2%

(Gains) losses on property

disposals, net:

YRC National Transportation $4,949 $1,312

YRC Regional Transportation 3,669 211

YRC Logistics 200 (6)

YRC Truckload 42 76

Corporate and other 138 -

--- ---

Consolidated $8,998 $1,593

SUPPLEMENTAL INFORMATION

March 31, December 31,

2010 2009

---- ----

Current debt:

Asset backed securitization

borrowings $117,667 $146,285

Lease financing obligations 2,265 2,671

Pension contribution deferral

obligation 70,000 20,500

Contingent convertible senior

notes 21,671 21,671

Industrial development bonds - 6,000

--- -----

Total current debt 211,603 197,127

Long-term debt, less current

portion:

Lease financing obligations 317,353 316,221

Pension contribution deferral

obligation 84,895 132,541

USF senior notes - 45,289

Term loan 112,507 112,612

Revolving credit facility 387,650 329,119

6% convertible senior notes 46,459 -

------ ---

Total long-term debt, less

current portion 948,864 935,782

Total debt $1,160,467 $1,132,909

========== ==========

Letters of credit

Credit facility 451,494 461,032

Asset backed securitization 72,180 77,180

Total letters of credit $523,674 $538,212

======== ========

SUPPLEMENTAL FINANCIAL INFORMATION

YRC Worldwide Inc. and Subsidiaries

(Amounts in thousands)

(Unaudited)

January 2010 February 2010 March 2010

------------ ------------- ----------

Reconciliation of operating

loss to adjusted EBITDA:

Operating loss $(48,839) $(41,878) $(146,103)

Depreciation and

amortization 17,271 16,987 18,003

Equity based compensation

expense 627 597 108,647

Letter of credit expense 2,850 2,714 2,790

Losses on property

disposals, net 35 (249) 9,212

Impairment charges - - 5,281

Other, net 484 901 (2,499)

Adjusted EBITDA $(27,572) $(20,928) $(4,669)

======== ======== =======

For the Three Months Ended March 31

2010 2009

---- ----

Reconciliation of operating loss to

adjusted EBITDA:

Operating loss $(236,820) $(379,247)

Depreciation and amortization 52,261 66,269

Equity based compensation expense 109,871 33,025

Letter of credit expense 8,354 5,473

Losses on property disposals, net 8,998 1,593

Impairment charges 5,281 -

Other, net (1,114) (1,888)

Adjusted EBITDA $(53,169) $(274,775)

======== =========

Adjusted EBITDA by segment:

YRC National Transportation $(60,313) $(238,506)

YRC Regional Transportation 8,356 (49,908)

YRC Logistics (5,943) (854)

YRC Truckload (211) 205

Corporate and other 4,942 14,288

----- ------

Adjusted EBITDA $(53,169) $(274,775)

======== =========

Adjusted EBITDA $(53,169) $(274,775)

======== =========

Friday, May 14, 2010

China Star Entertainment (HK:0326)

Background of the Company

China Star Entertainment Group was established in 1992 by Charles Heung, who is the studio's CEO chairman, with his wife, Tiffany Chen, serving as Vice Chairman and administrative producer. It is a huge distributor and film producer of films made mostly in Cantonese dialect.

China Star Entertainment and its subsidiaries are principally engaged in the production and distribution of films and television drama series that are in Chinese dialect, many of which have won various awards. The company has also engaged in the provision of artists management services and post-production services.

In recent years, it has restarted its hotel operations, and acquired a company that has claim on the profits of those generated in one of the VIP rooms in the Grand Lisboa, Macau.

(as taken from wikipedia)

I am sure that many of us have watched the films that they have produced, such as Love on a Diet, La Brassiere and My Left Eyes Sees Ghost.

In 2006, CSE acquired Kingsway Hotel Limited in Macau, and refurbished it before reopening it in August 2009. The hotel has 200 rooms, a gaming room, with table games and slot machines.

In 2008, CSE acquired Best Mind International Inc, which has a 100% in 0.4% of the turnover generated by Ocho Sociedade Unipessoal Limitada. Ocho is a junket representative in one of the VIP gaming rooms at the Grand Lisboa Casino in Macau. A profit guarantee was provided of HK$72 million, HK$192 million and HK$120 million for the period from 17 August 2007 to 31 December 2007, the year ended 31 December 2008 and the period from 1 January 2009 to 16 August 2009 respectively.

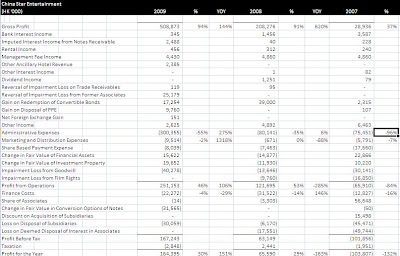

Income Statement

As we can see, the hotel operations were only started in 2009, and the gaming promotion operations started in 2008.

As we can see, the hotel operations were only started in 2009, and the gaming promotion operations started in 2008.What is interesting to note is that as of 2008, the gaming promotion operations generated HKD203,327,000, which as stated on the annual report was 34% higher than the HKD151,385,000, which was different from the profit guarantee as stated in their company profile of HKD 192million. Likewise, the profit guarantee was not restated in 2008 for the year 2007, of HKD 72million. I spent very long trying to figure out this red flag, and came to two possible conclusions. (1) the profit guarantee was restated as of date of acquisition, or (2) the company restated its profit guarantee as it sees fit.

This doubt did not last for long, as seeing the amount the gaming promotion operations is bringing in, it shows that the demand for gaming is there, and this would also help out its hotel business, which has its own gaming arm as well. Furthermore, it shows that high end gamblers are still flocking to Macau despite the financial crisis that happened. Overall, the revenue obtained from the gaming arm was about 29.7% more than the guaranteed amount.

Generally, the average occupancy rate of hotel rooms in Macau increased from 75.47% in March 2008, to 82.22% in December 2009, with a dip in between. As of March 2010, the average occupancy rate was hovering about 77%. Gross gaming revenue of Macau, however, has recovered from a previous high of MOP10,220million in March 2008 before the financial meltdown to MOP 11,450.6 in Dec 2009. In March 2010, gaming revenue was recorded at MOP13,665.9million.

Another point to note is how badly the film distribution arm is doing. The segment profit was HKD8,336,000 in 2007, a loss of HKD19,128,000 in 2008 and another loss of HKD11,738,000 in 2009. The company has attributed it to rampant piracy that is eating away at their margins, and in this case, posting net losses. I look for China Star Entertainment to divest its holdings or shut down its film distribution arm sooner rather than later.

The amount of turnover from the VIP room at Grand Lisboa has allowed it to increase its gross margins to 90%.

One thing that stands out is the admin expenses (the row where the cursor is). Admin expenses has risen by 275% year on year, while marketing and distribution expenses increased by 1318%. This was attributable to the opening of the LKF hotel in Macau, as SG&A expenses were incurred throughout the year, but revenue collection only started in August.

One thing that stands out is the admin expenses (the row where the cursor is). Admin expenses has risen by 275% year on year, while marketing and distribution expenses increased by 1318%. This was attributable to the opening of the LKF hotel in Macau, as SG&A expenses were incurred throughout the year, but revenue collection only started in August.Another point that makes me feel uncomfortable is the high finance costs, being 4% of sales. However, this is offset by the low cost of sales attributable to the Gaming Promotion Arm. I look for them to lower the absolute amount. There was a 29% decrease from 2008. Although the absolute bank borrowings increased (that will be covered in the Balance Sheet analysis), CSE has managed to reduce the interest expense due to lower borrowing rates. However, there is a bank overdraft liability that exists on the balance sheet that has not been paid off.

Over the past 2 years, CSE has retained most of its profit, only paying out 5.46% of its total profits made over the period.

The P/E ratio at its current price based on 2009 earnings is 0.66, while based on the current number of shares issued, the P/E average of 2 years earnings (since the acquisition of Kingsway Hotel and Best Mind International) is 1.16.

Balance Sheet

Several key figures found in the balance sheet

- Assets as of YE2009 totaled HKD3190million

- Current Assets as of YE2009 totaled 853million

- Intangible Assets + GW as of YE2009 totaled HKD998million

- Liabilities as of YE2009 totaled HKD870million

- Bank Borrowings totaled HKD410million, of which 232million is classified as current liabilities. There has been a marginal reduction of bank borrowings from 2008.

- Bank Overdraft was not repaid in 2009, instead it has increased from HKD174million to HKD 178million.

The figures are for 2009 (on the left) vs 2008. What is noteworthy is that the leverage of the company has decreased, and the current ratio of the company has increased. Although the net current asset per share is negative, it has been reduced from HKD-0.6 to HKD-0.02. The NTA of the company is at 1.43, a 33 cents increase from 2008. Given it's current price, it is trading at a discount of 89.5% to its tangible book value.

The figures are for 2009 (on the left) vs 2008. What is noteworthy is that the leverage of the company has decreased, and the current ratio of the company has increased. Although the net current asset per share is negative, it has been reduced from HKD-0.6 to HKD-0.02. The NTA of the company is at 1.43, a 33 cents increase from 2008. Given it's current price, it is trading at a discount of 89.5% to its tangible book value.Why Purchase?

There are some lingering doubts that I had before I purchased the shares of the company

(1) Why wasn't bank overdraft repaid? Are they in a need of cash for working capital purposes?

An analysis of the Cash Flow statement puts Free Cash Flow marginally positive for the year ended 2009. For 2008, FCF was negative. Working Capital was HKD46million for year ended 2009, compared to year ended 2008, which was HKD-34million.

With the reassurance that the cash flow was improving, the bank overdraft not being repaid does not warrant a huge emphasis. Instead, I would look the the company to decrease the overdraft over the next year.

(2) Lack of a Dividend

The company, even before it's diversification, has not paid out dividends to its shareholders except in 2008, of HKD0.02. This is due to the need to retain cash for its diversification policies in order to deal with the decreasing profits/increasing losses from the film distribution arm. I do not foresee a dividend in the coming year, however within the next 2 financial years, should results continue improving, the lack of a dividend would be a red flag.

(3) Possible Divestment of Film Distribution Arm

I would look for the company to divest its money bleeding film distribution arm over the next few years. Should the company continue this arm for reasons other than profiteering, I would have to reconsider the investment in CSE.

Conclusion

I definitely feel that CSE is a company reborn since its diversification. Its results have been impressive, and should it manage to reduce the bank overdraft over the next year, it would show good management decisions being made.

It would also be good to look at the results for the next few quarters, as the profit guarantee has expired. However, with the amount of revenue being brought in by the gaming promotion arm exceeding the profit guarantee, it does not seem like a big worry.

Tuesday, May 4, 2010

Portfolio Review Apr 2010

Internationally, Goldman Sachs, Greece along with the rest of the PIGS, and the volcanic ash cloud from Iceland which shut down European airspace were the main focus of this month.

News that Goldman Sachs was facing a criminal probe into its activities with regard to mortgage transactions sent the stock spiralling, losing approximately US$30 (17%) off each share since the news broke. The essence of the story was that Goldman Sachs is accused of failing to notify the investors that Paulson and Co, a hedge fund, helped select mortgages for one of its products, and then bet against it. Paulson and Co has been absolved of any blame in this case. The story is still unravelling. More can be read here.

Greece once again took the focus of investors worldwide, with protests going on in Greece as the unions are against the austerity measures that the government has to introduce in order to receive a bailout from the EU and IMF. The failure of Greece to obtain the bailout has resulted in its debt being downgraded to junk bond status by S&P. In the same day, Spain's debt was downgraded, although not to junk bond status. It was also reported that Spain's unemployment had hit 20%, putting it in the same league as Latvia.

Many jokes were spun about Iceland's volcanic ash eruption. The first country to suffer from the financial crisis in Europe, it yet again became another starter of events. This time, the volcano (don't ask me what's its name, I'm pretty sure even Icelanders are unable to spell it right) spewed ash, forcing a shutdown of European airspace, causing a disaster to airlines worldwide, leaving many stranded. The shutdown of the airspace racked up losses for airlines. The full extent however, is still unable to be determined, as airlines and governments are negotiating on any compensation available.

Locally, news that grabbed the headlines was the opening of the circle line from Tai Seng to Dhoby Ghaut. Although it has not affected me, the feedback thus far was that it has managed to cut short journey times. As the government tries to move away from long distance bus, it would have an effect on SMRT as well as SBS Transit as publicly traded companies.

Housing prices has continued rising (making me look like a fool in the process), and there seems to be no end, with many property owners near the Circle Line trying to cash in on the current property market boom in tandem with the opening of the Circle Line itself.

My portfolio took a huge hit, dropping 2% from the month before. In addition, I sold Transpac Industrial Holdings in order to remain partially in cash, and to take advantage before the dividends were paid out.

First Resources

First ResourcesFirst Resources had its AGM on the 28th of April. It was my first ever AGM and it was interesting hearing the management comments. Of course there were questions that were posed that seemed out of management control.

The CEO and I had a chat, and he put it across to us that the company's growth, even if they did not have any new plantings or acquisitions, would still be robust. Greenpeace allegations that Golden Agri faced were also a topic. He confidently said that Greenpeace was definitely an issue with plantations, and the main way to resolve it was to talk to them, which in the case of First Resources, they had an open door policy with Greenpeace.

Hearing that was good that the management avoided saying that they would never face the situation, but instead said about what they would do if it happened.

China Telecom

China Telecom reported 1Q results, with net profit down 9% on increased 3G spending. Sales however, rose 3.6%. The results meant analysts expectations. The stock however, has took a tumble over the past two weeks due to broad market factors, as well as it China telecom companies rotational play. However, the story behind China Telecom is still intact, as it added 9.36million subscribers in 1Q, compared to 4.93million subscribers the year before.

Novo Group

Little news came out of Novo Group, besides the selling of the remaining 10million treasury shares. There are no treasury shares remaining in Novo after the sale.

Blue Gem Enterprise

Blue Gem Enterprise has expanded into the Refrigerated Direct Store Delivery Division, and thus is able to diversify into the distribution of dairy products on top of beverages. More news can be found here.

Soilbuild

Soilbuild announce that it has won an industrial site bid at Yishun Ave 6 for $29.3million. It is slated to be for SMEs and supporting businesses of MNCs in Singapore. At the EGM, it also approved of the 2 for 1 stock split on the 25th of May.

YRC Worldwide

YRC results are slated to be at 930ET today. Just before the end of the month, YRC Worldwide's stocks dropped like a rock, without any reasons. More can be found here. However, I did not add to my positions, preferring to remain in cash to explore other opportunities, as well as waiting for the results announcement before deciding.

Tuesday, April 27, 2010

Trip up to KL

(1) Mature and Immature

Sounds really easy at first, where mature palms are those that are able to produce palm fruits and immature ones are those that have not started producing fruits. Travelling along the highway, what I saw was the really new plantations, where you see the palm leaves just sprouting; medium height plantations, where you could see a short trunk; and the older palms, where it looks exactly like a tree.

So when do palm trees produce their highest yield? That was an immediate concern that came to my mind. Firms may classify their palms as mature, however it may be near the tail end or past the peak production age. What I found out was palm oil yields were highest were from the 6th year to the 12th year. After that, the yields will start decreasing.

(2) What happens after death?

I saw a few plantations where there were withering trees, or just clearings. A few questions came to my mind.

First, what is the life of the palm tree, and given that yields decline after 12 years of age? In the article "The Optimal Age of Palm Oil Replanting", they have stated that the optimal age of replanting based on marginal revenues would be of 30 years of age, when after that the palm trees get too tall, and yields will be too low to support the labour costs. However, I have my doubts on the viability of replanting trees when they reach 30 considering that yields may be too low to sustain the total sum of all costs (including SG&A costs).

Second, how long will it take before the land is viable to replace palm trees? Would they do better to replant on uncultivated land or replant on land that has been planted on before? Thus far, I am unable to determine the answer to the question, and I am currently finding more information on this topic. However, one thing I noted was if it ever came to this situation, chances are the company does not have a large enough land bank, which may be detrimental to future expansion plans.

(3) Wide Open Spaces

One thing I noticed is that wherever there was wide open spaces, there were palm trees. From an industry point of view, it would mean that there will be ample supply. However, this may cause prices to be depressed in the situation where supply exceeds demand. Interestingly, with the current weather patterns said to cause yields to be lower, the issue of supply outstripping demand has not been a big issue to deal with as yet. In the future, there is a need to consider this supply demand balance.

Later today, I will be attending FR's AGM, and I hope it would be a good experience (especially with the food). There will be a summary of the AGM, and a review of property prices coming up in the next week or two.

Wednesday, April 14, 2010

Forex and Politics

On the Financial Times yesterday, there was an article about the upcoming elections in Britain (Britain is arguing about the past, by Philip Stephens). This article got me thinking about how politics and economy of a country is intertwined.

When Gordon Brown announced that elections were going to take place on May 6th, this is what happened between the GBP/AUD is shown below.

What is interesting here to note is that the GBP had a 200point dip against the AUD in a little over 4 hours. The large drop was due to the worries that neither party would be able to able to secure a majority in the upcoming elections. Although it has since recovered, to 1.6521, and admittedly forex is extremely sensitive to political instability, questions popped up in my head about governments and how political instability, flawed monetary policies, or just plain mismanagement can affect a country's finances and economy.

What is interesting here to note is that the GBP had a 200point dip against the AUD in a little over 4 hours. The large drop was due to the worries that neither party would be able to able to secure a majority in the upcoming elections. Although it has since recovered, to 1.6521, and admittedly forex is extremely sensitive to political instability, questions popped up in my head about governments and how political instability, flawed monetary policies, or just plain mismanagement can affect a country's finances and economy.The best example would be Zimbabwe. Any country with inflation rates that high ought to be listed in the Guinness Book of Records. Other examples that come to mind would be as recent as the PIGS incident, where spending sprees by government has come back to haunt them. Likewise, low interest rates in US helped fuel the housing boom which resulted in the subprime crisis that we have all come to know.

Somewhere in the middle of the article, Stephens writes:

"Colleagues of Mr Cameron say he is confident about being the next prime minister: the nation, they judge, cannot contemplate the prospect five more years of Mr Brown. This tells us little about the Tory alternative"

I thought this was quite apt in describing the political situation in Singapore. With house prices increasing, without our salary matching it, and with COE prices increasing probably due to the change in number of COEs provided, it makes me wonder what happens when I graduate and start a family.

It makes me wonder whether a change in the number of opposition in government would be a good solution that would change policies that we have right now. However, from what I read from several websites, Temasek Review being one of them, it cast a lot of doubt on the quality of the opposition because simply, there isn't enough news on them and the positive things they have done. Instead it is more like an anti-PAP session than a positive opposition session. It seems that the idea is either NBP (nothing but PAP) or ABP (anything but PAP).

Looking at how several bad policies as mentioned earlier would have an adverse impact on the economy, my vote rests with the party that is able to prove that they are able to do a better job, instead of competing for which is the lousier of the 2 parties. If PAP's policies are working for Singapore's economy, I really don't see a need to change because I don't see much benefits.

Once again, I would like to reiterate that this is my personal opinion, and the only inducement is to provide a point of view for everyone.

Tuesday, April 13, 2010

Mencast Holdings

About Mencast Holdings

Established in 1981, Mencast manufactures and supplies sterngear equipment and provides sterngear services for a wide range of commercial vessel applications.

Mainly caters to customers in the offshore oil and gas and marine industry, our customers include local and regional shipyards and owners, such as the subsidiaries within the offshore and marine business division of Keppel Corporation Limited, Labroy Shipbuilding and Engineering Pte. Ltd. and the subsidiaries of SembCorp Marine Ltd.

Led by a dedicated and experienced management team, as well as equipped with advanced machinery and strong technical expertise, Mencast is committed to providing quality products and services to our customers. We are one of the first sterngear equipment manufacturers in Singapore to obtained the ISO9001:2000 Quality Management System certification. In addition, we achieved the Singapore SME 500 award for two consecutive years in 2005 and 2006.

Strategically based in Singapore, Mencast is well-positioned to ride on the growth in the offshore oil and gas and marine industry.

Structure of Group

(as taken from mencast.com.sg)

(as taken from mencast.com.sg)First Thoughts on Mencast

When I was first told about Mencast and what they did, he looked at it as they provided a unique service that shipping companies needed. Furthermore, there were no other companies that specialized in building and maintaining ship parts.

The first thought that hit me was shipping. Earlier in the year, I did a research on dry bulk shipping and the shipping industry as a whole and not surprisingly, there was overcapacity in the sector resulting in low freight rates. Tankers however, fared better than dry bulk, with a higher demand.

I am currently avoiding shipping counters currently and may review it after this earnings season. (I bet those people out there holding NOL and Cosco will be laughing at me right now.) So when he first told me about Mencast, I was (and still am) negative about the industry as compared to the company itself.

I will give the upside on the industry at the end of this piece, although I remain underweight on it.

Mencast Income Statement

Since 2007, Mencast's revenue has grown approximately 39.19%, and COGS has been at 54% of sales on average over the past 3 years. Since its IPO in 2008, the Sterngear Manufacturing division's revenue has dropped by 3%, while the Sterngear Services division revenue increased by 16%, all together contributing to a 4.83% increase in revenue since its IPO.

Since 2007, Mencast's revenue has grown approximately 39.19%, and COGS has been at 54% of sales on average over the past 3 years. Since its IPO in 2008, the Sterngear Manufacturing division's revenue has dropped by 3%, while the Sterngear Services division revenue increased by 16%, all together contributing to a 4.83% increase in revenue since its IPO.This large topline growth has contributed to a 35% adjusted growth over 3 years for operating profit. One thing to note about operating profit for 2009. The Other Gains includes one off gains, and the figure of 35% does not take into account this one off gain. Net Profit excluding one off gains increased by 25% since 2007.

Since the IPO however, excluding one off gains, Operating Profit has increased by 5%, and Net Profit, excluding one off gains (in this case I included the IPO expense as a one off), fell by 1% from 2008 to 2009.

This translated to a P/E ratio of 6.6 at the end of FY2009, and a 3 year trailing P/E of 7.2.

Taking into account the theoretical growth rate (ROE x Retention Ratio) using the amount retained by the company, the PEG ratio comes in at 0.67 assuming continuous 20% growth. Using the earnings per share growth, however, the PEG ratio was 1.22 for FY2009. This assumes that the P/E of SGX trades at a 50% discount to NYSE.

Mencast Balance Sheet

Mencast NAV value for 2009 was SGD0.181, an increase of 4cents from 2008. Its NTA, however, was SGD0.16 for FY2009. This translated to a P/B ratio of 1.65 for FY2009. ROE decreased due to a decrease in the Asset Turnover Ratio, due to the increased amount of PPE they have taken on since the IPO.

Mencast NAV value for 2009 was SGD0.181, an increase of 4cents from 2008. Its NTA, however, was SGD0.16 for FY2009. This translated to a P/B ratio of 1.65 for FY2009. ROE decreased due to a decrease in the Asset Turnover Ratio, due to the increased amount of PPE they have taken on since the IPO.The company has also taken on long term debt of 8345k at YE2009, compared to 2937k at YE2008. The increase in Finance Expense in the income statement to 1.3% of sales from 0.5% of sales shows that the company has incurred more debt, though not necessarily a bad thing should they wish to expand.

Mencast Cash Flow

Mencast Free Cash Flow has been positive over the past 3 years, with FCF 52% of Operating Cash Flow for 2009. For 2009, the dividend paid was 47% of its free cash flow.

Opinions on Mencast

Mencast is tied closely to the shipping industry, and with the shipping industry still at the bottom of a down cycle, I believe that Mencast would be have a buy rating if we are looking at industry wise, and if there were no opportunity costs. However, purchasing Mencast stocks exposes us to opportunity costs as we would have to wait to see signs of recovery from the Shipping industry.

Mencast is slightly overvalued at this current time, especially with limited growth prospects. The issue with Mencast is that there are no other companies to do relative comparisons.

Due to my negative forecast on the shipping industry, coupled with the analysis of Mencast, I would not think right now is the correct time to purchase Mencast Holdings Inc.

Shipping Industry

For readers who are still reading this, I wish to point out something regarding the shipping industry. Right now shipping seems to be at the bottom of a down cycle, and the question should be asked how low can it go. If your analysis tells you that the economy is recovering and commodities boom is going to reduce the capacity of the shipping sector, you should purchase shipping companies. I believe shipping would recover by 1H2011, and I actually own shares in a LTL company, YRC Worldwide, although it is banking more on the turnaround of the company, and hopefully an early recovery in transportation.

Thursday, April 1, 2010

Portfolio Review

In Singapore, property prices soared yet again (looks like that has been the story for the past months). HDB prices rose 2.7% over the first 3 months compared to the 3 months before that. Private home prices are also through the roof, breaking its 2007 high by 6% for non landed private homes and landed homes are 15.6% ahead. More interestingly, private home prices are above their 1996 peak, meaning that home prices are their highest ever.

I am still neutral, tending to the underweight side on residential property. I do not think that high prices are here to stay because

- Government restrictions on new foreigners in Singapore will not increase the demand of property

- The effect of the IR is still unclear, with reports of it being frequented more by foreign workers instead of gamblers

- The government has been releasing land for developers to bid, in an attempt to increase the supply of housing

Transpac

TranspacThe dividend ex date was announced to be 3rd May, and upon announcement, the share price went up by 10cents, factoring in the dividend payout

First Resources

Company results were announced on 1st March, and can be found here.

Industry wide, Nestle has announced that it will not source palm oil from Sinar Mas Group in a victory for Greenpeace. Sinar Mas Group has been accused of deforesting while carrying out of its agricultural activities. Nestle has sourced from Sinar Mas only for its Indonesian businesses, and has announced that it will change suppliers. This is good for the industry as it seeks to produce palm oil while reducing damage to the environment. It also gives other companies in the industry to attract new customers.

Palm oil prices are well supported by energy prices, says James Fry, as the agri business and the energy business becomes more intertwined. The article can be found here.

China Telecom

China Telecom FY2009 results were announced, and the results were positive. The news article can be found here. As for the detailed analysis, it will be out before the end of April, hopefully by the end of next week.

Novo Group

Novo Group released its 3Q results, achieving tremendous improvement. It has also started preparing for its scrap metal business, which is scheduled to come online is 2011. The analysis can be found here. Operating Profit was up by 186%, and Net Profit up by 816% for 9M2010 as compared to 9M2009.

I am looking forward to Novo to increase the long term debt of the company as an indicator of expansion plans.

Blue Gem

Products have gone on sale at more Walgreens stores in Florida. I am looking forward to the release of the financial statements

Soilbuild

Soilbuild announced that the stock split has been approved in principle, in an attempt to increase liquidity. Many shareholders have been converting their warrants in an anticipation of the 6cents dividend payout, with the ex date on 7th May

YRC Worldwide

YRC Worldwide has announced that shipping trends over the 1st quarter has shown signs of improvement, and that its customers have been returning. I look for its cost cutting targets to be hit by mid year.

YRC Worldwide's independent auditors have announced that it has doubts on YRC Worldwide's ability to act as a going concern. It has seeked a court ruling to prevent a 20 million bond payment to its bondholders who did not agree to the debt to equity swap back in December. It has said that should the court ruling be approved, the 20million will be used to help its recovery thus far.

Prospective Companies

I am looking at several companies who have large land on their balance sheet. Furthermore, I am looking at Palm Inc as another turnaround play. Should there be a prospect for investment, I will do a writeup.

I am very busy for the next week, so apologies if there isn't much update for the next week.

Monday, March 29, 2010

Novo Group 3Q Results

Income Statement

Sales for 9M09 were down 18%, and cost of sales were down 23%. However, for the 3Q09, sales were up 67.7%, with an increase in cost of sales to 60.3% as compared 3Q08.

Sales for 9M09 were down 18%, and cost of sales were down 23%. However, for the 3Q09, sales were up 67.7%, with an increase in cost of sales to 60.3% as compared 3Q08.The reduction in the cost of sales contributed to a 186% increase in Operating Profit. This was also affected largely affected by change in other operating expenses. Other Operating Expenses

experience a 96% drop for year to date, due to a large decrease in foreign exchange losses.

Finance costs for the year to date decreased by 66%, total of 0.24% of sales. Net Profit for the year to date increased by 816%, and a profit margin of 3%. Estimated P/E for the year, assuming equal earnings through 4 quarters, was 7.3x.

As Novo is currently a supply chain manager and does not have an upstream mining facility, the profit margin of 3% is respectable. As it is actively growing, I would look to have profit margins between 3% to 5%.

Balance Sheet

Novo has a slightly weaker balance sheet as compared to the FY2009 due to its expansion activities.

- Current Ratio has dropped from 2.98 to 2.26

- Net cash per share of -0.04 as compared to a positive net cash position

- Asset per share has increased by 2 basis points to 0.12.

- Debt/Equity is 0.74, compared to 0.49 in 2009

- ROE is at 18%, compared to 4% in FY2009

- P/B has dropped from 1.55 to 0.20

The assumed increase in debt should be used for capital expenditures to expand Novo's business. If there is a large decrease in cash used for capital expenditures, there would be a flag for me. Likewise, if the gross PPE does not increase, another flag would be raised.

Overall, the balance sheet reflects that the company is in the growing stage and is starting to pursue expansion plans.

Cash Flow

Capital Expenditures was 1,357k YTD2008 up from 27k YTD2009. Free cash flow was negative.

Opportunities for the Future

China has a huge demand for raw materials as it grows, among which there is high requirement for steel due to the need for it to build infrastructure to support its growth. In 2009, the iron ore imports increased by 42% to 628million metric tonnes. Novo has secured fixed quantities of raw materials to be supplied from mining companies.

Novo has also intended to commence its scrap metal business in 2011. The capital spent to set up the business will be estimated at USD24million.

Saturday, March 27, 2010

The Ten Bagger Principle

For a background on Peter Lynch, please refer to this link.

The first thing I would like to address is the idea of a bagger. A two bagger will be a stock that multiplies twice, while a ten bagger would be a stock that multiplies itself ten times. It's derived from baseball, although bowling has the same name for the number of strikes you get after a turkey.

Peter Lynch is a strong advocate of the buy and hold strategy, and he has stated that 2 points

- If an investor goes by the philosophy that he will sell if the stock goes up 50%, he will never be able to obtain a bagger. Likewise if you go by the philosophy of selling the stock when it is a two bagger,you will never be able to obtain a ten bagger.

- Show him a portfolio with a stop loss of 10%, and he will be able to show you a portfolio that loses 10%.

I personally feel that taking profit is never a bad thing, and buying low and selling high is an excellent strategy (I mean who wouldn't, that's the essential of making money). The question comes is how to time the market. Maybe there are few beings out there with superior ability as compared to most of us investors that are able to tell when is the bottom and the top. And the list of investors that will be able to do that wouldn't have my name on it.

Buying and holding undervalued companies would instead provide a return that wipes out market irrationality and rides through economic boom and bust. The fact is that many of us are unable to time the market. Further evidence can be found here. Finding companies that are undervalued will provide us with the margin of safety for investment, minimizing possible downside and increasing possible upside.

I believe that should there be no external influences such as a requirement for money, selling should only occur if there is a(n) (anticipated) change in the fundamentals of the company or macroeconomic conditions, or that you require to reposition your portfolio. I would like to emphasize that stock picking is important, and sitting on for the ride is extremely important.

I leave everyone with an idea that Peter Lynch was putting across.

If I had 10k, and I invested 1k in 10 companies. If one of the undervalued companies produces a 10x returns, essentially the other 9 companies can be declared bankrupt and I did not make any losses. This is the effect of the ten bagger.

Monday, March 22, 2010

China Telecom FY2009 results

By LORRAINE LUK

HONG KONG--China Telecom Corp., the country's largest fixed-line operator by subscribers, reported a jump in full-year net profit as the company's year-earlier result was weighed by an impairment loss associated with its mobile business.

China Telecom has been trying to boost its competitiveness in the mobile business after buying rival China Unicom (Hong Kong) Ltd.'s code division multiple access business in 2008 as part of a government mandated restructuring of its telecom sector.

But despite the purchase, China Telecom has still been a laggard in the mobile business compared with China Mobile Ltd. and China Unicom. Analysts said competition in the industry is likely to rise further this year and operators will be bogged down by higher marketing expenses and rising network depreciation costs.

Net profit for the 12 months ended Dec. 31 rose to 14.42 billion yuan (US$2.11 billion), from 884 million yuan a year earlier, when the company booked a 24.17 billion yuan impairment loss on property, plants and equipment mainly associated with the mobile business. The year-to-year jump was in line with expectations.

Stripping out the one-off impairment loss and amortization of non-cash connection fees, the company said its adjusted profit for last year was 13.27 billion yuan, down 34% from an adjusted profit of 20.07 billion yuan in 2008.

Revenue rose 12% to 209.37 billion yuan from 186.53 billion yuan.

China Telecom said it plans to increase its capital spending slightly this year on high-growth broadband and value-added mobile services amid rising competition in China's telecommunications industry, which it said poses serious challenges for the company. China Telecom plans capital spending of 39 billion yuan this year, up slightly from 38.04 billion yuan in 2009.

To boost its competitiveness, the company plans to offer Research In Motion Ltd.'s Blackberry devices in China in May and Palm Inc.'s Pre handsets in July, Chairman and Chief Executive Wang Xiaochu said at a news conference.

China Telecom is the second Chinese mobile operator to sign a deal with Canada-based RIM to offer Blackberry devices. China Unicom offers Apple Inc.'s iPhones. China Telecom hopes Blackberry devices will help attract more affluent customers in Chinese cities. RIM has offered Blackberry handsets to big businesses in China since 2006 through China Mobile, the world's biggest telecom operator by subscribers.

Average revenue per user--a key industry gauge to determine the long-term growth rate of telecom operators--for China Telecom's mobile business fell to 59.50 yuan in 2009 from 63.40 yuan a year earlier because of tough competition, the company said.

Mr. Wang said the company will continue its efforts to make its mobile business profitable, and that he expects it to turn a profit in 2011.

Mr. Wang reiterated the company expects its core profit—which excludes items such as impairment and amortization of upfront connection fees—bottomed out in 2009 and will resume growth this year. The company said selling, general and administrative costs in 2009 rose 47% to 40.51 billion yuan from 27.5 billion yuan a year earlier, mainly driven by handset subsidies of 10.1 billion yuan in the 12 months ended Dec. 31.

Last year, handset subsidies accounted for 33.6% of the company's mobile revenue, lower than the company's previous guidance of 37%.

China Telecom plans to lower its handset subsidies as a proportion of mobile revenue this year, Mr. Wang said. The company plans subsidies of more than 10 billion yuan to meet its target of adding 30 million mobile subscribers in 2010, including eight million third-generation, or 3G, subscribers.

China Telecom said it had 56.29 million mobile subscribers at the end of December, of which 4.07 million were 3G users. It maintained its target of having more than 100 million mobile subscribers in 2011.

To mitigate the decline in its fixed-line voice business, China Telecom has been focusing on increasing its revenue from value-added services.

Mr. Wang said the company is offering mobile payment services in 18 cities by cooperating with Chinese banks. But he said "China Telecom has no plan...and I think no need to invest in a Chinese bank for mobile payment services. We are already cooperating well with the local banks."

The comments came after China Mobile said this month it planned to buy a 20% stake in Shanghai Pudong Development Bank Co. for 39.8 billion yuan to expand into mobile payment services.

Monday, March 15, 2010

YRC Worldwide

About YRC Worldwide

YRC Worldwide Inc., a Fortune 500 company and one of the largest transportation service providers in the world, is the holding company for a portfolio of successful brands including YRC, YRC Reimer, YRC Glen Moore, YRC Logistics, New Penn, Holland and Reddaway. YRC Worldwide has the largest, most comprehensive network in North America with local, regional, national and international capabilities. Through its team of experienced service professionals, YRC Worldwide offers industry-leading expertise in heavyweight shipments and flexible supply chain solutions, ensuring customers can ship industrial, commercial and retail goods with confidence. The company is headquartered in Overland Park, Kan.

(as taken from yrcw.com)

YRC Worldwide does transportation of goods mainly across North America, and main business is in the Less Than Truckload and Full Truckload market segment. Its division YRC Logistics in charge of international freight forwarding and providing full logisitical support.

What is Less Than Truckload and How Does it Differ from Full Truckload?

As the name suggests, LTL serves the middle ground between parcel services and full truckload services, and its goods weigh between 50kg to approximately 9000kg. LTL shippers will collect freight from various shippers and consolidate the freight at the terminal for sorting before delivering the freight.

Although LTL is cheaper than FTL, it takes longer to reach its customer as there are many intermediaries along the way. LTL delivery time is dependent on the number of terminals between the sender and the destination, while FTL is dependent on the distance. A visual example will be passing the parcel down the row till it reaches the final destination, while FTL would be throwing the parcel from the first person to the last person.

The key point here is that if the amount of LTL freight a company has is large, it is able to reduce cost by cutting the number of terminals between the sender and the destination by using FTL carriers to deliver from terminal to terminal.

This is why large freight carriers are good investments as it provides a cheap method of transporting items over long distances. This model works in countries with large land mass and a large population.

Freight carriers, esp LTL and FTL carriers across land are close to pure plays on the economy of the country.

YRC's Bankruptcy Issue

YRC Worldwide was extremely close to bankruptcy at the end of last year, due to its high rate of cash burn, and only managed to evade bankruptcy due to a debt for equity swap done at the end of the year. This resulted in the dilution of outstanding shares from 90million to 2billion.

The trigger for the large cash burn was due to macroeconomic conditions and other conditions in the industry. As we all know, consumer confidence in the USA has taken a downturn over the past 2 to 3 years, since the subprime crisis started and turned into what we know it as today. The economic downturn meant that less goods were demanded by retail outlets, resulting in a drop in volume of freight services, reducing the revenues earned industrywide. Freight service providers would then cut their prices in order to maintain their volume, sending price spiralling.

This macroeconomic effects of the economic crisis resulted in excess capacity in the freight sector, and even at present, this excess capacity still exists. Many have viewed that should there be a bankruptcy filing by YRC Worldwide, it would restore the supply and demand balance across the industry.

YRC Worldwide Financials

I am viewing this company as a turnaround. Just some notable figures that back up my decision include

- Pre tax loss for FY2009 was USD899million, an decrease from a pre tax loss of USD1,149million for FY2008

- 4Q2009 pretax loss was USD95million, down from pretax loss of USD335million in 4Q2008

- 4Q2009 pretax loss decreased the loss from 3Q2009 pretax loss of 118million, however, 2% to 4% of revenues are seasonal

- 4Q2009 National shipments down 39.9%, revenue down 4.2% compared to 4Q2008

- 4Q2009 Regional Shipments down 19.9%, revenue down 7.7% compared to 4Q 2008

What lies ahead?

I do not believe that the American economy will turnaround and give the LTL freight industry a boost. In my opinion, in order for the economy to turn around, it requires a 2 prong boost.

- The increase in consumer confidence

- The increase in employment rate

However, what is attracting me is the massive cost reduction that is carried out by YRC Worldwide. Their aim to reduce costs by 200million by mid of 2010 would strengthen its balance sheet. Furthermore, since YRCW had completed the debt for equity swap, it has retained approximately 85% of its customers as customers are more confident about YRCW's ability to continue as a going concern.

YRCW analysts are predicting the company to be solvent in 2010, and may occur solvency issues in 2011. I am of that same view that insolvency may trouble YRCW in 2011, if (1) they are unable to meet cost cutting targets, and (2) USA's economy doesn't pick up. I believe that should cost cutting targets be met, YRCW would exit this crisis with a stronger, albeit smaller, company.